Annual income tax calculator

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Guaranteed maximum tax refund.

Income Calculator With Taxes Flash Sales 60 Off Www Al Anon Be

On this page Which tax rates apply Before you use the calculator Information you need for this calculator What this calculator doesnt cover Access the calculator.

. Your average tax rate is 270 and your marginal tax rate is 353. Assume that Sally earns 25. This marginal tax rate means that your immediate additional income will be taxed at this rate.

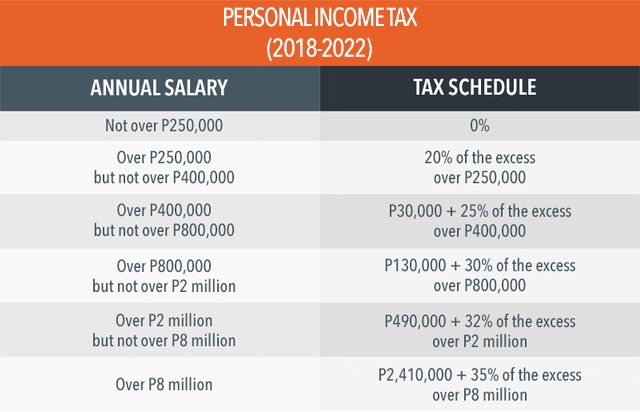

How to calculate Federal Tax based on your Annual Income. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Ad Offering You Simple And Easy-To-Use Tools For Your Maximum Confidence This Tax Season. It also will not include any tax youve already paid through your salary or wages or any ACC earners levy you may need to pay.

Lets work through how to calculate the yearly figure by using a simple example. That means that your net pay will be 43041 per year or 3587 per month. Learn more in CFIs Free Accounting Finance Courses.

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Your average tax rate is 217 and your marginal tax rate is 360. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Max refund is guaranteed and 100 accurate. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. That means that your net pay will be 37957 per year or 3163 per month.

Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

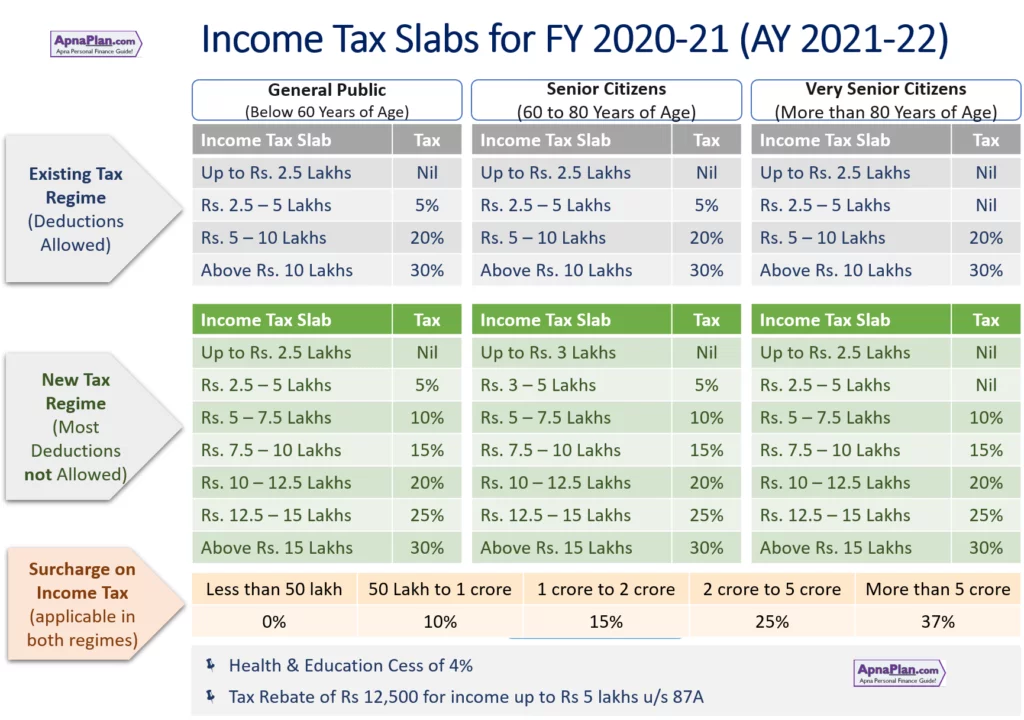

It can be used for the 201314 to 202122 income years. Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax calculator to review NIS payments and income tax deductions for 2022. Income Tax Calculator in India helps determine the tax payable by individuals for the year 2020-21 considers tax rates levied as follows For individuals Hindu undivided families HUFs and NRIs for income generated in India For senior citizens above 60 years For super senior citizens above 80 years.

Ad Free tax filing for simple and complex returns. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022-2023. Example of Annual Income Calculator.

Using the annual income formula the calculation would be. No Matter What Your Tax Situation Is TurboTax Has You Covered. Free means free and IRS e-file is included.

Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. Where the taxable salary income does not exceed Rs.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Hourly Daily Weekly Monthly Income Conversion. Hourly Employee with Unpaid Time Off Being paid by the hour means that your annual income is affected by the number of hours that you work.

The concept applies to both individuals and businesses in preparing annual tax returns. How to use BIR Tax Calculator 2022. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Philippine Public Finance and Related Statistics 2020. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

Tax Calculator Compute Your New Income Tax

Taxable Income Formula Examples How To Calculate Taxable Income

What Is Annual Income How To Calculate Your Salary

Excel Formula Income Tax Bracket Calculation Exceljet

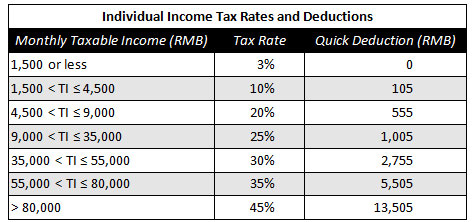

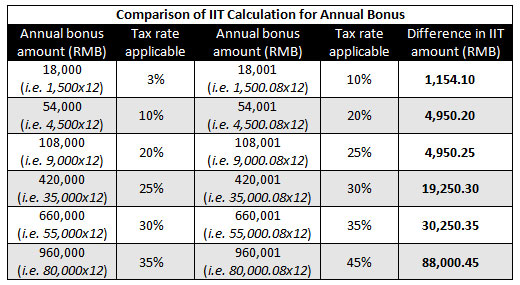

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Tax Calculator For Salary Discount 59 Off Www Quadrantkindercentra Nl

Taxable Income Formula Examples How To Calculate Taxable Income

Online Income Tax Calculator Online 53 Off Www Ingeniovirtual Com

Income Tax Calculator For Self Employed Shop 56 Off Www Ingeniovirtual Com

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Annual Income Calculator

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

Taxable Income Formula Examples How To Calculate Taxable Income

Online Income Tax Calculator Hot Sale 56 Off Www Ingeniovirtual Com

Salary Tax Calculator Online 60 Off Www Wtashows Com

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas